- Home

- Services

- Verticals

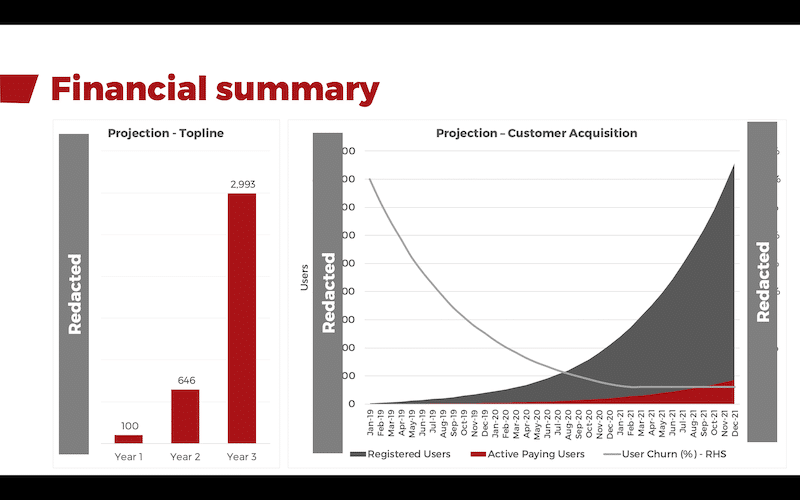

- Pitch Deck for SaaS

- Pitch Deck for Fintech

- Pitch Deck for Blockchain

- Pitch Deck for E-Commerce

- Pitch Deck for Metaverse

- Pitch deck for Virtual Reality

- Pitch Deck for Healthcare

- Pitch Deck for Cybersecurity

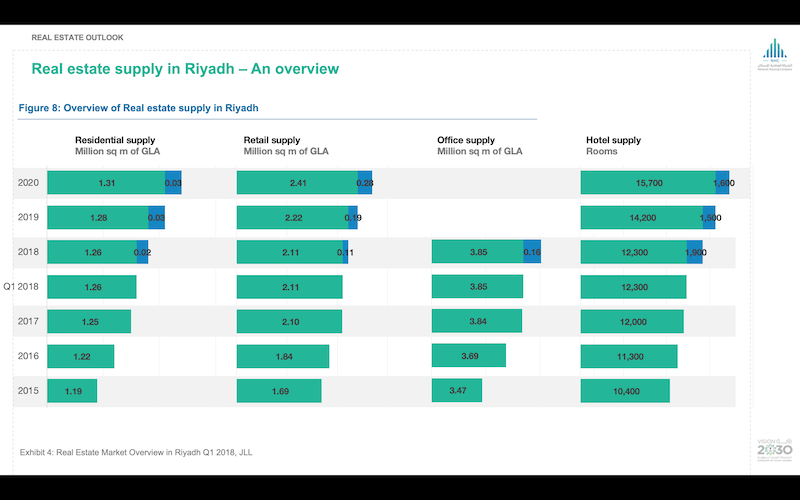

- Pitch Deck for Real-estate

- Pitch Deck for FoodTech

- Pitch Deck for Fashion

- Pitch Deck for EdTech

- Pitch Deck for Automation

- Pitch Deck for 3D Printing

- Pitch deck for Sports and Gaming

- Pitch Deck for Drone

- Pitch Deck for Robotics

- Pitch Deck for AI & ML

- Pitch Deck for Nano Technology

- Pitch Deck for Beauty

- Pitch Deck for Internet of Things

- Pitch Deck for Restaurant Tech

- Pitch Deck for Big Data

- Resources

- Testimonials

- Contact

Abhishek was a pleasure to work with. He was fast and efficient when building my business plan. He was also patient throughout the edits I asked him to make during the project. I would recommend him for others when it comes to making Business Plans/Pitch decks.